CPA Evolution

CPA Exam Information

Information for Candidates & Students

Changes to the CPA Exam structure

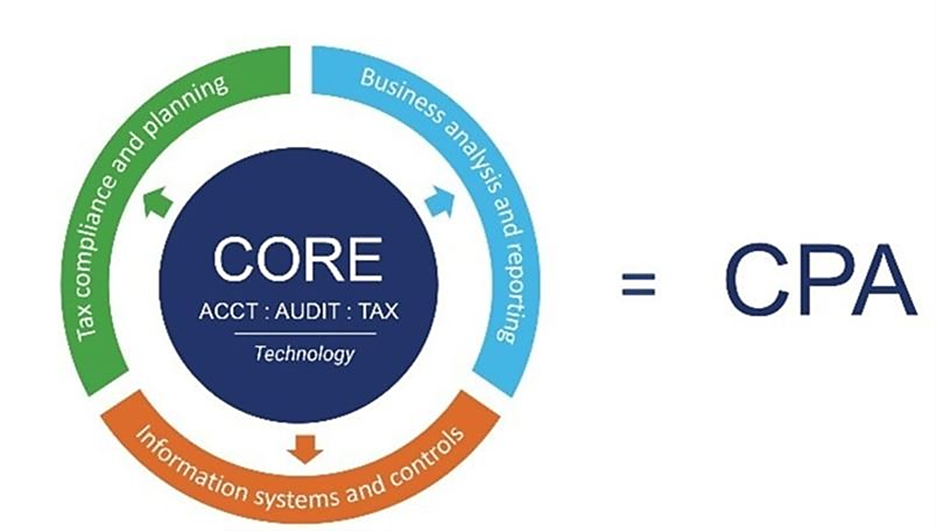

Core Section: The 2026 CPA Exam format still includes these three Core exams: Auditing and Attestation

(AUD) Financial Auditing and Reporting (FAR) Taxation and Regulation (REG) Candidates

must also pass one of three Discipline sections. CPA Exam Blueprint for 2026 | Becker

Discipline Section: Test takers are required to take one of the following disciplines. Each one is centered

on more specialized knowledge and skills gained in the Core sections:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Under the CPA Evolution model launched in 2024, CPA candidates must pass three Core exams (AUD, FAR, and REG) plus one Discipline exam, which allows students to tailor the CPA path to their career goals. The three discipline options are Business Analysis & Reporting (BAR) for those interested in advanced accounting and financial reporting, Information Systems & Controls (ISC) for students drawn to technology, IT risk, and controls, and Tax Compliance & Planning (TCP) for those pursuing tax-focused careers. Becker’s CPA Review helps students explore all three options with a trial period and structured prep, making it easier to choose a discipline aligned with their strengths while still earning the same CPA license regardless of the discipline selected. Information on the Core and three Disiplince options, read more on the Becker.com, Choosing your Discipline Section.

New Model for Licensure, New CPA Exam

Transition policy announced for the 2024 CPA Exam (2-2-2022). Frequently Asked Questions are available that might answer some of your more detailed questions regarding the

newly released transition policy.

Becker emphasizes that 2026 candidates should:

- Use continuous testing to move quickly through Core sections

- Schedule the Discipline exam last or around work/school commitments

- Choose a Discipline aligned with career goals (audit/IT, analytics/reporting, or tax)

- Plan exam order carefully to avoid delays caused by Discipline testing windows

Core Section Score Release Timeline for 2026

For Core sections, score releases occur frequently throughout the year. Examples from the AICPA’s 2026 schedule include:

- Exam data received by January 23 → Score release February 10

- Exam data received by April 23 → Score release May 7

- Exam data received by July 23 → Score release August 7

- Exam data received by October 23 → Score release November 10

- Exam data received by December 31 → Score release January 12 (2027)

This rolling score release system helps candidates move through the exam faster.

Discipline Sections Still Have Limited Testing Windows

Unlike the Core sections, Discipline exams (BAR, ISC, TCP) are only available during specific windows in 2026:

2026 Discipline Testing Windows & Score Releases

- January 1 – January 31 → Score release: March 13

- April 1 – April 30 → Score release: June 16

- July 1 – July 31 → Score release: September 11

- October 1 – October 31 → Score release: December 15

Candidates must plan carefully when scheduling their Discipline exam. [becker.com]